The Rebel Banker: How Muhammad Yunus Made the Poor Creditworthy and the Impossible Real

The Rebel Banker: How Muhammad Yunus Made the Poor Creditworthy and the Impossible Real

Most banks turn away the poor.

Muhammad Yunus built one for them.

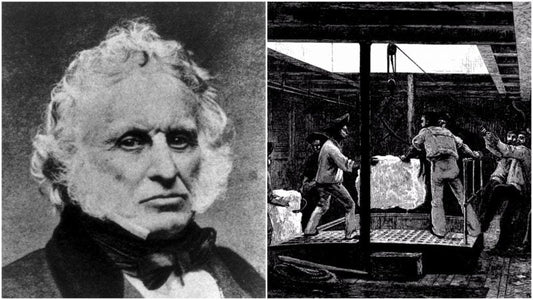

In a quiet village in Bangladesh in the 1970s, Yunus then an economics professor, met a group of women trapped in debt. They borrowed tiny amounts to buy bamboo and materials, but the lenders charged so much interest that profit was impossible. Their work kept them poor.

Yunus saw something others didn’t.

He didn’t see poverty.

He saw potential.

So, he lent $27 of his own money to 42 women. No contracts. No collateral. Just trust.

They paid him back. Every single one.

That act of belief sparked a global movement. Yunus went on to found Grameen Bank, a bank built for those who had nothing but dreams. His idea was radical: lend to the poor, especially women, and they will use that money to build businesses, support their families, and escape poverty.

Today, this model has been studied in universities, tested in global economies, and replicated across continents. It’s more than a system, it’s a philosophy that puts human dignity at the center of finance.

Microfinance: A Quiet Revolution

Microfinance wasn’t just a financial tool. It was a moral statement.

It said: Everyone deserves a chance.

It proved that the poor are not a problem to be solved, but partners in building solutions.

Since then, microfinance has reached hundreds of millions of people around the world. It has helped launch businesses, educate children, and reshape entire communities.

Yunus didn’t stop there.

He introduced the world to the idea of social business, a business created not to make money, but to solve a problem. Profits don’t go to investors. They go back into the mission.

To Yunus, business was never the enemy of good. It was the missing piece of the puzzle.

“Making money is no fun. Contributing to and changing the world is a lot more fun.” — Muhammad Yunus

Click here to listen to the full podcast

Yunus is a textbook example of a Corkscrew Mind, someone who sees a problem, turns it sideways, and creates a solution no one saw coming.

He challenged the system by asking:

Why are banks only for the rich?

What if trust, not collateral, was the foundation of lending?

What if businesses could exist just to make lives better?

These questions bent the rules. And then rewrote them.

For entrepreneurs, educators, NGO workers, and policymakers, Yunus reminds us:

Innovation doesn’t always look like a tech startup or a billion-dollar idea.

Sometimes, it’s a $27 loan and the courage to believe in someone no one else will.

Yunus teaches us that change doesn’t need to be loud. It needs to be consistent, rooted in empathy, and bold enough to challenge the norms we’ve accepted as truth.

What Can You Do?

-

Question the obvious. The status quo is only one version of reality. Bend it.

-

Start small. A big change often starts with a small act of trust.

-

Design for dignity. Empower, don’t just help.

-

Build with purpose. If your work isn’t solving a real problem, why are you doing it?

Muhammad Yunus didn’t just invent microfinance. He gave us a new way to see the world.

He saw potential where others saw risk. He saw partners where others saw charity. And he taught us that true innovation isn’t about wealth or status, it’s about daring to believe differently.

What problem around you is waiting for a Corkscrew solution?

You might not need permission.

Just vision, and a bit of rebellion.